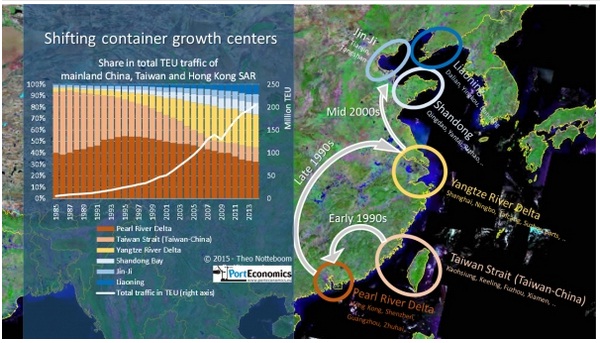

Only 25 years ago, the container port system in mainland China was still in its infancy stage. During that time, Hong Kong acted as the only container gateway to China and Taiwanese ports Kaohsiung and Keelung benefited from Taiwan's economic success story in international trade. In May 1980, the Chinese government established the Shenzhen Special Economic Zone, the first special economic zone in China. By the late 1980s, mainland Chinese ports in the Pearl River Delta saw the first fruits of this opening up policy. Growth dynamics slowly started to shift from Taiwan to the Delta following port development in Shenzhen, Guangzhou and later also in other ports. As a result, the Pearl River Delta recorded an average annual growth in container volumes of 19.3% between 1985 and 1995. The market share of the Delta peaked in 1995 at 55%. In the ten following years the Delta's growth remained high with traffic increases of between 12 and 13% per year. Still, other regions outperformed the Delta in terms of growth.

The Chinese government developed a strong focus on Shanghai in the mid-1990s. As a result the Yangtze River Delta emerged as the container port growth region in China reaching an elevated average annual growth of 30% between 1995 and 2005. The region increased its market share in combined China/Taiwan/Hong Kong container port traffic from 5.6% in 1995 to 30% in 2008, with Shanghai and Ningbo as the main growth engines. In the early 1990s, the Shanghai Port Authority started to convert general cargo terminals into container terminals, building dedicated container terminals at the Waigaoqiao area. Efforts were also made to build the Waigaoqiao area into a procurement and distribution centre for the Asia Pacific Region. The growing capacity problem and the lack of deep-water berths were solved by the construction of a new port at the Yangshan islands, 100 km south of Shanghai and 30 km offshore. In December 2005, phase one was opened. Phase four is planned to be completed in 2017 and should bring the port's container handling capacity to 40 million TEU.

Today, the centre of gravity in container growth is no longer in the Yangtze River Delta. The Delta recorded an average yearly growth of 6.6% in the period 2010-2014 with a moderate growth of 5.2% in 2014 compared to 2013. The strongest growers are now to be found in northeastern China, more in particular in the Shandong, Jin-Ji and Liaoning port regions. Annual growth in these regions for the period 2010-2014 was 12.1%, 10.7% and 19.6% respectively. As a whole the greater Bohai Rim recorded an average annual growth of 13% in the past five years, while the Pearl River Delta and Yangtze River Delta recorded 2.2% and 6.7% respectively. Not only the large ports in the Bohai Rim such as Dalian, Tianjin and Qingdao are driving growth in Northeast China, but also a lot of new kids on the block such as Yingkou, Dandong, Yantai, Rizhao and Tangshan.

At the same, we see a recovery in the relative importance of the Taiwan Strait, mainly driven by growth in the Mainland Chinese port of Xiamen and spurred by the start of direct cross-Strait sea transport services on December 15, 2008. The Taiwanese Ministry of Transportation and Communications (MOTC) reported that in 2014 direct cross-Strait container traffic amounted to 2.48 million TEU compared to 1.56 million TEU in 2009, the year after the opening up of direct services.

The above discussion underlines that it is important to focus on regional dynamics when talking about the development of the Chinese container port system. After all, it is a large country with different regional speeds.

Source: porteconomics.eu

Sidebar

28

Κυρ, Απρ